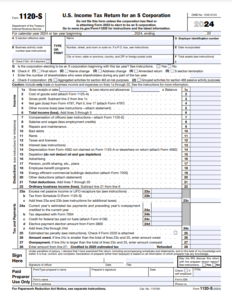

Form 1120-S is more than just a tax form; it’s a snapshot of a company’s journey that details profits, losses, and shareholder contributions.

Did you know that over 5 million S Corporations in the United States rely on Form 1120-S to report their financial health each year? That’s a lot of 1120-S!

For business owners, navigating this form is a balancing act between compliance and strategy—because every line filled shapes the financial future of their company.

Key Takeaways

- Form 1120-S is the income tax return for S corporations that’s used to declare its income, losses, deductions, and credits for the tax year.

- The profits and losses of S-corporation go directly to the shareholders, who then report these amounts on their personal tax returns.

- S-corporations are domestic and can’t have more than 100 shareholders.

What is Form 1120-S?

Form 1120-S refers to the U.S. Income Tax Return for an S Corporation. It’s a five-page informational return that reports income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. Every S corp. needs to file one, including LLCs that are taxed as S corps.

What Are the Benefits of Filing Form 1120-S?

Filing form 1120-S allows S corporations to report their income and expenses accurately, potentially reducing their tax liability. It also provides shareholders with financial transparency and can help them obtain financing or attract investors. Filing an accurate Form 1120-S helps avoid penalties of up to $450 per shareholder for failure to file

When is Form 1120-S Due?

Form 1120-S is due on the 15th day of the third month after the end of the corporation’s tax year.

For example,

if a corporation’s tax year ends on December 31st, then the Form 1120-S would be due by March 15th of the following year.

Note: If the 15th falls on a weekend or holiday, the deadline may be extended to the next business day.

1120-C vs. 1120-S: What Are the Differences?

Here’s a comparison of Form 1120-C and Form 1120-S:

| Form 1120-C (C-Corporation) | Form 1120-S (S-Corporation) | |

| Purpose | Reports income, gains, losses, deductions, and credits of a C-Corporation | Reports income, gains, losses, deductions, and credits of an S-Corporation |

| Taxation | Subject to double taxation (corporate level and shareholder level) | Pass-through taxation (income taxed at shareholder level) |

| Shareholders | Unlimited number of shareholders | Limited to 100 shareholders, all must be U.S. citizens or residents |

| Filing Deadline | April 15 (calendar year) or 15th day of the 4th month after the fiscal year-end | March 15 (calendar year) or 15th day of the 3rd month after the fiscal year-end |

| Form Used for Shareholders | No separate form for shareholders | Schedule K-1 issued to shareholders to report their share of income |

| Eligibility Requirements | No restrictions on type of corporation | Must file Form 2553 to elect S-Corp status and meet specific IRS requirements |

| Income Distribution | Dividends paid to shareholders after corporate tax | Income distributed directly to shareholders without corporate tax |

| Loss Deduction | Losses can be carried forward or back to offset taxable income | Losses passed through to shareholders to offset their personal income |

| Audit Risk | Generally lower audit risk | Higher audit risk due to potential misuse of pass-through taxation |

Final Thoughts

In conclusion, Filing Form 1120-S is essential for S corporations to stay compliant and maximize tax benefits. It ensures accurate reporting of income, deductions, and shareholder distributions while avoiding penalties. By understanding its purpose and deadlines, business owners can navigate tax obligations smoothly and keep their companies financially strong year after year. Use X.Tax to file your Form 1120-S easily and accurately, keeping your business financially strong and in good standing with the IRS.